Nike Air Shake NDestrukt Dennis Rodman 2017 Retro | Sole Collector | Nike air shoes, Mens nike shoes, Sneakers men fashion

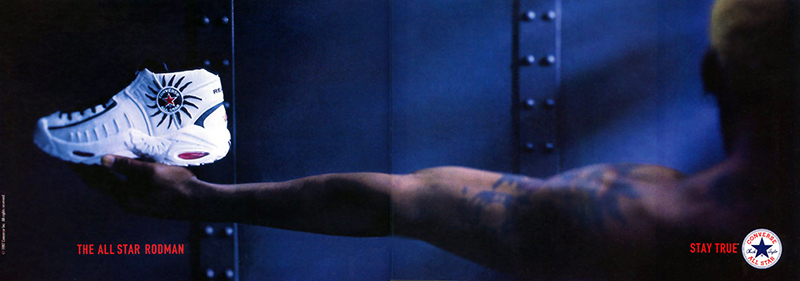

Worm Wear: A Complete History of Dennis Rodman's Sneakers | Converse basketball shoes, Dennis rodman shoes, Sneakers